Industry employment in England can look different depending on whether we consider cities or the wider Combined Authorities that the cities anchor.

One of our most recent reports, the 2023 edition of our annual economic research ‘Enabling growth across the UK’, quantifies the contribution the financial and related professional services industry makes in each UK region and nation by looking at industry employment and GVA.

Our report analyses data at the levels of region (eg, North East), town/city (eg, Newcastle) and constituency (eg, Newcastle upon Tyne East). Our data is based on data from Nomis and the Office for National Statistics (ONS), which provide official statistical designations of regions, towns and cities, and parliamentary constituencies. These geographical/statistical boundaries differ from other, more politically-oriented designations, such as Combined Authorities.

Defining geographical boundaries can be more complicated than one might imagine. The ONS explained to us that local authority geography represents the area of the district council area—an administrative area defined by the Local Government Boundary Commission. In contrast, ‘major towns and cities’ is a designation created by ONS to provide a more precise definition of the built-up extent of a town or city. The ONS notes:

"Existing analysis of towns and cities in England and Wales is often based on local authority district (LAD) data. While a LAD-based definition accurately captures some places, especially the larger cities, for other places it is less useful. For example, for many of the smaller cities and larger towns, the LAD definition includes a significant rural hinterland as well as the main urban settlement.[1]"

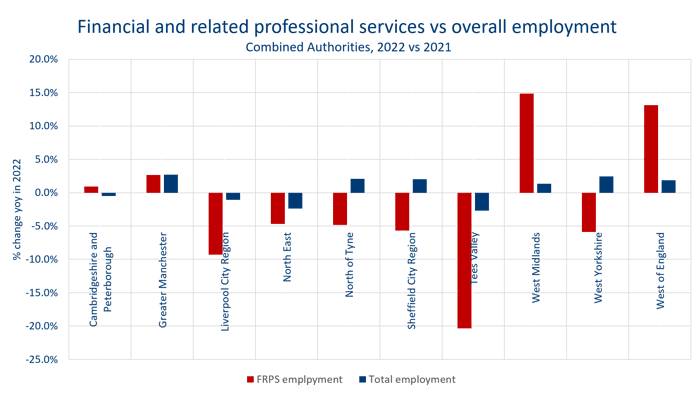

There are currently nine Combined Authorities in England under the jurisdiction of a Metro Mayor, and one without a directly elected mayor (North East Combined Authority). In order to deepen our understanding of financial and related professional services clusters in the UK, we have undertaken additional analysis since the publication of our recent report, looking at industry employment in the Combined Authorities to augment the city-focused data in the report.

We find that the Greater Manchester, West Midlands and West Yorkshire Combined Authorities had the highest levels of financial and related professional services employment in both 2022 and 2021. When looking at the wider conurbations, Greater Manchester registered more than 140,000 in industry employment in 2021 compared to the West Midlands’ 91,000 (the Combined Authority, not the region). In contrast, the city-level data featured in our report revealed Birmingham outpacing Manchester—just—with industry employment of around 59,000 compared to Manchester’s 52,795.

Data for 2022 (released after the publication of our report) for each Combined Authority, is shown in the chart below. Use the filter to show data for 2021 instead, or data for 2021 and 2022 in aggregate.